Operating Real Estate Office

Table of Contents

- Operating A Real Estate Office in Florida

- Intended Learning Outcomes

- Business Structures That May Be Registered as Brokerage Entities

- Other Business Form That May NOT Register As Real Estate Brokerage Entities

- Use of Trade Names (Fictitious Name) as Real Estate Brokerage

- Office Requirements as Real Estate Brokerage

- Americans with Disabilities Act (ADA)

- Advertising and Self-promotion as Real Estate Brokerage

- Federal Fair Housing

- Rental lists

Operating A Real Estate Office in Florida

Intended Learning Outcomes

- Describe the characteristics of the various business structures that may be registered as brokerage entities and the statutes/rules pertaining to operating under a broker’s own name

- Know the requirements associated with registering a trade name and registration of general partnerships, limited partnerships, and corporations as real estate brokerage entities

- Know the statutes/rules regarding a change in the composition (or a vacancy) in the partnership, what action is taken if a partner is not properly licensed or registered, including what activities limited partners may perform

- Recognize the various business forms that may not register as real estate brokerage entities

- Know the rules and requirements regarding real estate brokerage offices, branch offices, and temporary shelters

- Understand the accessibility requirements outlined in the Americans with Disabilities Act pertaining to public accommodations and commercial facilities

- Know the statutes/rules pertaining to classified advertising and self-promotion, “for sale” signs and “sold” signs and rental lists

- Understand the Fair Housing Act as it applies to advertising and the display of the Fair Housing Poster

- Understand the provisions of the Federal Communications Commission’s (FCC) do-not-call rules and describe the applicable exemptions under Florida’s Telephone Solicitation Law

Business Structures That May Be Registered as Brokerage Entities

Sole Proprietorship as Real Estate Brokerage

A business owned by one person is a SOLE PROPRIETORSHIP. In order to offer real estate services to the public, the sole proprietor must be an active real estate broker. This person is personally liable for the business and the acts of the agents working for the brokerage.

General Partnership as Real Estate Brokerage

A business owned by two or more individuals who share in the profits and losses is called a GENERAL PARTNERSHIP. No formal document must be signed or filed to create a general partnership, although good business practice suggests that partners should sign a “Partnership Agreement” which outlines their respective duties, rights, and obligations. In order for a General Partnership to offer real estate services to the public, at least one of the partners must be an active real estate broker.

A General Partnership may register with the Florida Real Estate Commission (FREC) to broker real estate with the following conditions:

1. At least one of the partners must be an active Florida real estate broker2. Sales associates and broker associates cannot be partners of the brokerage General Partnership

3. Any unlicensed individuals acting as a partner (they must not provide real estate services) must register their names and addresses with the FREC.

In a general partnership, the death, bankruptcy, or withdrawal of a partner causes the dissolution of the partnership. But under Commission rules, there is no change if two or more partners continue the brokerage operation. The Commission (FREC), however, must be notified in order to drop the former partner from its records and to add any new partners. If already licensed, a new partner must register his or her license as being affiliated with the partnership. In the event the only active broker of the partnership dies or resigns, that partnership shall have 14 days to register a new broker of record or else the partnership registration shall be canceled.

When a partnership is created out of circumstances and not a choice, this is considered an OSTENSIBLE PARTNERSHIP.

If the public perceives two or more persons to be partners, and the “partners” are responsible for that perception, the courts may deem them to actually be partners.

For example, a real estate broker opens up an office and places her official sign on or about the entrance of the office. A second broker moves into the same office building but fails to post the required official sign. If that second broker defrauds the public, the law may consider them to be ostensible partners rendering both brokers liable for the fraud.

Limited Partnership as Real Estate Brokerage

In Florida, a LIMITED PARTNERSHIP is formed by filing articles with the Florida Department of State. A Limited Partnership consists of one or more limited partners and one or more general partners. Limited partners are investors only and do not participate in the daily operations of the business. The general partner acts as not only the “goal-setter” for the business but is also responsible for all business operations.

A Limited Partnership can register with the FREC to broker real estate with the following conditions:

- At least one General Partner must be an active Florida real estate broker

- Sales associates and broker associates cannot participate as general partners

- Any unlicensed individual acting as a general partner (he or she must not provide real estate services) must register his or her name and address with the FREC

- Anyone, including sales associates and broker associates, can be a limited partner provided he or she does not act in the capacity of a General Partner

- A Limited Partnership can be dissolved through a vote of the Limited Partners or through judicial action

Limited Liability Partnership (LLP) as Real Estate Brokerage

A Limited Liability Partnership is a business entity that protects the partners from personal liability against the acts of the partnership. However, limited liability partners are responsible for their own acts or the acts of others under their direct supervision and control. Limited Liability Partnerships are created by filing with the Florida Department of State and are authorized to operate as a real estate brokerage in Florida.

Corporation as Real Estate Brokerage

In Florida, a CORPORATION is formed by filing articles of incorporation with the Florida Department of State, Division of Corporations. A corporation is owned by stockholders who are liable only to the extent of their investments. Stockholders elect a Board of Directors who act as “goal-setter” for the corporation. The Board of Directors hires the officers, such as the President and Vice President, to handle the day-to-day activities of the corporation.

Corporations are classified as either “Corporation for Profit” or “Not for Profit Corporation.” Either type may register as a real estate brokerage.

A corporation can register with the FREC to broker real estate with the following conditions:

- At least one of the officers must be an active Florida real estate broker

- Sales associates and broker associates cannot participate as officers or directors of the brokerage corporation

- Any unlicensed individual acting as an officer or director (he or she must not provide real estate services) must register his or her name and address with the FREC

- Anyone, including sales associates and broker associates, can be a stockholder in a real estate corporation provided he or she does not act in the capacity of a Director or Officer

- In the event the only active broker of the corporation dies or resigns, that corporation shall have 14 days to register a new broker of record or else the partnership registration shall be canceled

A domestic corporation is a corporation that is domiciled in the state of Florida. A foreign corporation is a corporation that is domiciled outside the State of Florida (e.g., a Georgia corporation is considered to be a foreign corporation). Foreign corporations operating within the state of Florida must register as foreign corporations with the Florida Department of State, Division of Corporations in order to legally conduct business in Florida.

Corporations can be dissolved by action of the stockholders, administrative dissolution by failing to file an annual report with the Florida Department of State, or through judicial dissolution.

Subchapter “S” of the Internal Revenue Code provides that certain closely held corporations (no more than 100 stockholders, all of whom must be citizens or residents of the United States) may register as an “S” corporation and avoid the consequences of double taxation by allowing a special flow-through of profits to stockholders so that no tax is owed on the corporate level.

Subchapter “S” of the Internal Revenue Code provides that certain closely held corporations (no more than 100 stockholders, all of whom must be citizens or residents of the United States) may register as an “S” corporation and avoid the consequences of double taxation by allowing a special flow-through of profits to stockholders so that no tax is owed on the corporate level.

Limited Liability Company (LLC) as Real Estate Brokerage

A Limited Liability Company is a business entity that combines some of the best features of a corporation and partnership into one entity. The members are protected against personal liability, but the IRS regards the Limited Liability Company as a partnership for tax purposes. Limited Liability Companies are created by filing with the Florida Department of State and are authorized to operate as a real estate brokerage in Florida.

Other Business Form That May NOT Register As Real Estate Brokerage Entities

Several business forms are not allowed to register as real estate brokerage entities.

Corporation Sole

A corporation sole is a religious (ecclesiastical) organization where no formal documents are required. Title to church property is held by a senior church member (e.g., bishop), and title passes to the successor in office.

Joint Adventure

Like a general partnership, a joint adventure (or joint venture) consists of two or more people doing business together to share in the profits and losses but only for one or more specific transactions. Each joint venturer is responsible for the acts of the other joint venturers. If two brokers enter into a co-brokerage arrangement, it is technically a joint venture. These individuals have already licensed brokers; therefore, additional registration is not required.

Business Trust

Also known as a syndicate, the business trust is owned by unit holders (similar to stockholders of a corporation). Title is held in the name of a trustee. The business trust is created by filing a declaration of trust with the Florida Secretary of State.

Associations

A cooperative association is a type of business entity authorized to engage in limited forms of commercial activity. Usually, cooperative associations are organized by a group of business individuals to effectively market a product or service (e.g., Shell Management’s Co-operative).

Unincorporated Association

An unincorporated association is created when two or more individuals come together for a common purpose but do not form a traditional business organization. For example, a homeowner’s association that fails to incorporate itself by filing articles with the Secretary of State would be considered an unincorporated association.

Use of Trade Names (Fictitious Name) as Real Estate Brokerage

An individual broker, partnership, or corporation may use a trade name. It must be disclosed upon the request for a license and placed upon the registration or license. It cannot be the same as the real or trade name of another registrant or licensee. No individual, partnership, or corporation may be registered under more than one trade name. The actual name of the individual is not a trade name.

Such a name must be noted on the records of the Commission and placed on the license so that the public will know that this is a licensed broker and a registered company.

Fictitious Name Act

Suppose a broker wishes to call his brokerage company A.N. SHELL Realty Because there is no person, living or dead, called A.N. SHELL Realty the broker will want to use a fictitious name. This is not to be confused with an alias (negative connotation). The name must be registered with the Division of Corporations of the Department of State. Once registered, the name is valid for a period of 5 years and expires on December 31 of the fifth year.

To register, the following information is needed:

- The name to be registered;

- The mailing address of the business;

- The name and address of each owner, and if a corporation, its federal employer’s identification number, and Florida incorporation or registration number.

Registration is simple, it registers the name with the Division of Corporations, but it does not warrant or guarantee the name against other users or guarantee the validity of the contracts of the company.

Failure to comply with this act results in a MISDEMEANOR OF THE SECOND DEGREE as provided for in 775.082 or 775.083. The forms may be obtained from the Department of State as per 606.06.

The fee for registration is $50

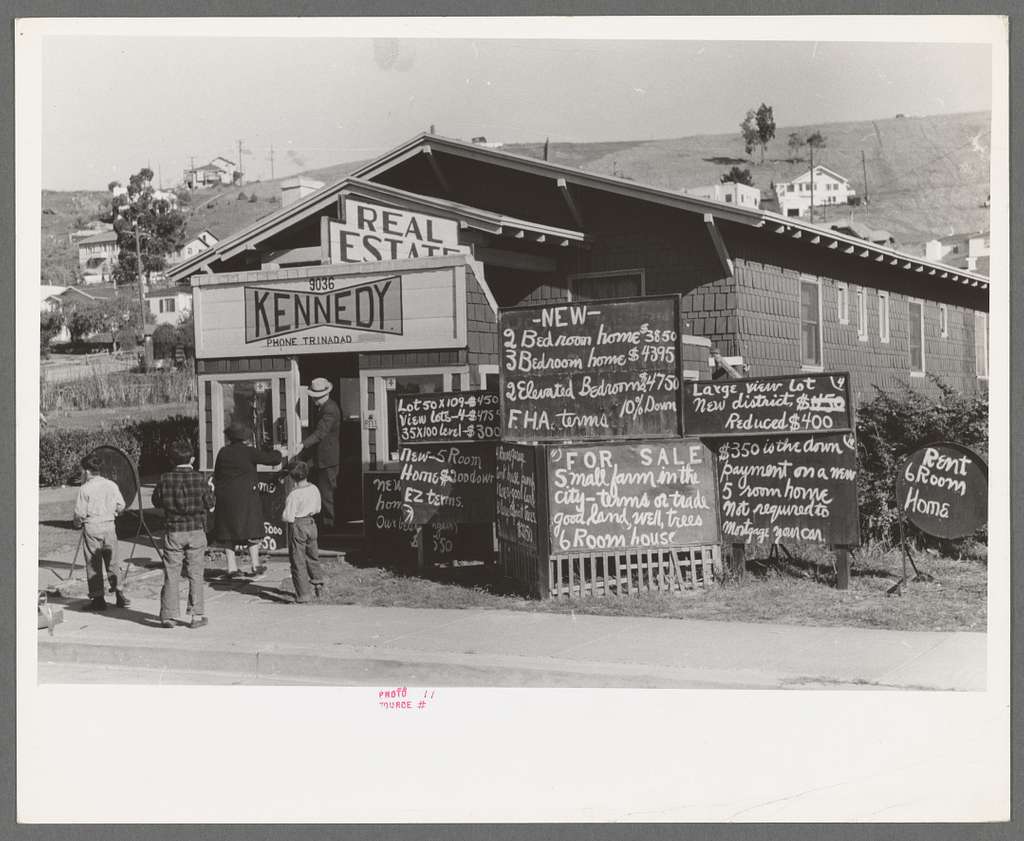

Office Requirements as Real Estate Brokerage

Principal Office Requirements

Every active broker must have a registered office, although the office does not have to be located in Florida. By definition, an “office” must be at least one enclosed room of stationary construction where negotiations take place and records are kept.

Branch Office Requirements

A branch office is any office other than the broker’s main office. The main office and all branch offices must be registered with the FREC with a registration period of two years. If a broker chooses to move a branch office to another location, a new registration must be obtained. Branch office registrations are not transferable.

NOTE: If a broker moves out of a branch office and then back into the same location within the same registration period, no new registration is required.

Sales associates and broker associates can be either registered at the main office or branch office location, but they have the ability to work at any of the brokerage locations.

Be careful not to confuse the concept of “temporary shelter” with the term branch office. A temporary shelter is a location where a broker operates, although it is used for other necessary functions. For example, a construction trailer where agents talk to customers and give out brochures while at the same time it is used to store construction equipment and other vital information belonging to the contractor is not considered to be a branch office. If the location, however, is used for negotiations or the signing of contracts, consider the location of a branch office.

Entrance Signs

Every brokerage office and branch office must have an official sign on or about the entrance. The contents of the sign must include the:

⭐ Name of the brokerage entity (if any)

⭐ Name of the broker (as it appears on his or her license)

⭐ Words “Licensed Real Estate Broker” (Lic. is acceptable)

⭐ Every word must be spelled out in its entirety except that the word “Licensed” can be abbreviated to “Lic.”

Sales associates’ and broker associates’ names are not required to appear on the official sign. However, their names may appear on the official sign, provided their names and license types are separate and distinguishable from the broker.

Advertising and Self-promotion as Real Estate Brokerage

Brokers must always advertise in a manner that alerts the public that they are dealing with a real estate professional. All advertisements in the name of the broker are his responsibility, no matter who composed them. All advertising must contain the name of the firm which is registered with the Department.

If it is not clear from the advertisement that it is a real estate firm, additional disclosure must be added, such as Licensed Real Estate Broker or REALTOR®. No real estate advertisement by a licensee shall show only a post office box number or telephone number, or other vague information so that the public does not know that it is a licensee. Such an ad is called a blind ad, and it is illegal under Florida Law.

If a sales associate or broker associate’s name appears in the ad, the name of the firm must be identified as well as the status of the sales associate or broker associate.

Advertising includes ads for purchasing, renting, or leasing real property as well as any advertising given to the public such as pens, notepads, etc.

When advertising on the Internet, the brokerage firm name shall be placed adjacent to or immediately above the Point of Contact information. “Point of Contact” refers to any means by which to contact the brokerage firm or individual licensee, including mailing address, physical street address, e-mail address, telephone number, or fax machine number.

When a property sells or the listing expires, the advertising sign must be removed. It is illegal to put a sold sign on the property without the consent of the seller.

Punishment of misleading or false information given by a broker is punishable by an administrative fine of up to $1,000 per count and/or a one-year suspension.

A blind ad is an advertisement that does not make it clear that a broker or real estate company is advertising the property for sale, rent or lease. The name of the broker must always appear in the advertisement.

Federal Fair Housing

The Federal Fair Housing Act is a major part of a broker’s business each and every day. Every broker should be very familiar with the facets of this Act. The Fair Housing Act prohibits discrimination in housing for a multitude of reasons.

Discrimination based on the following reasons is prohibited:

⭐ Race or color

⭐ National origin

⭐ Religion

⭐ Sex

⭐ Familial status (including children under the age of 18 living with parents or legal custodians; pregnant women and people securing custody of children under 18)

⭐ Handicap

The Fair Housing Act covers most housing, with a few exceptions. In certain circumstances, the Act exempts owner-occupied buildings with no more than four units, single-family housing sold or rented without the use of a broker, and housing operated by organizations and private clubs that limit occupancy to members.

The Federal Fair Housing Act covers the following housing:

✔️ Houses

✔️ Apartments

✔️ Condominiums and cooperatives

✔️ Rental mobile homes and their sites

✔️ Boarding houses and dormitories

✔️ Vacant land intended for residential use

Federal Fair Housing Prohibitions

In the sale and rental of housing, NO ONE may take any of the following actions based on race, color, national origin, religion, sex, familial status, or handicap:

⭐ Refuse to rent or sell housing

⭐ Refuse to negotiate for housing

⭐ Make housing unavailable

⭐ Deny a dwelling to any person

⭐ Set different terms, conditions, or privileges for the sale or rental of a dwelling

⭐ Provide different housing services or facilities

⭐ Falsely deny that housing is available for inspection, sale, or rental

⭐ Persuade owners to sell or rent (blockbusting or panic peddling) for the profit of the broker. For example, Agent Smith tells residents of a neighborhood that minorities are moving into the neighborhood and that property values are sure to fall. Resale values will suffer, and crime will increase, and if the owners don’t sell their homes now, they will lose their investment

⭐ Deny anyone access to or membership in a facility or service (such as a multiple listing service) related to the sale or rental of housing

In mortgage lending, it is prohibited to take any of the following actions based on race, color, national origin, religion, sex, familial status or handicap:

⭐ Refuse to make a mortgage loan

⭐ Refuse to provide information regarding loans

⭐ Impose different terms or conditions on a loan

⭐ Discriminate in appraising property

⭐ Refuse to purchase a loan

⭐ Set different terms or conditions for purchasing a loan

⭐ Threaten, coerce, intimidate or interfere with anyone exercising a fair housing right or assisting others who exercise that right

⭐ Advertise or make any statement that indicates a limitation or preference based on race, color, national origin, religion, sex, familial status, or handicap

This prohibition against discriminatory advertising applies to single-family and owner-occupied housing that is otherwise exempt from the Fair Housing Act.

The Penalty Issue

There are high penalties chargeable for violation of the fair housing laws. There are two avenues of correction — one administrative and one judicial — available to complainants.

An aggrieved person may complain directly to a U.S. District Court within one year of the alleged discriminatory practice, whether or not a verified complaint has been filed with the Secretary of HUD.

Equivalent Anti-discrimination Judicial Rights and Remedies

However, in states with equivalent anti-discrimination judicial rights and remedies, such a suit would have to be brought in state court. In this type of suit, the burden of proof lies with the complainant. The court can and may grant permanent or temporary injunctions, a temporary restraining order, or other appropriate relief.

The court may award actual damages, and there is no cap on punitive damages. The parties can agree to have the case decided by an administrative law judge.

Criminal penalties are provided for those who coerce, intimidate, threaten, or interfere with a person’s buying, renting, or selling of housing, making a complaint of discrimination, or exercising any rights in connection with these laws. Licensees should keep detailed records of all transactions and rentals in order to defend themselves against possible discrimination complaints. Violations are frequently proven through the use of “testers,” and the courts have ruled that there is no requirement that the testers actually be bona fide purchasers or renters.

1st offense – $16,0002nd offense (within 5 years) – $37,500

3rd offense (within 7 years) – $65,000

How Fair Housing Affects Real Estate Professionals

Differences in housing availability — Properties must be offered to all consumers on an equal basis without violating any of the Fair Housing Laws.

Differences in professional services cannot and will not be tolerated with regard to the Fair Housing categories.

Differences in qualifying information will also not be tolerated. You must qualify all consumers using the same forms and techniques.

Unsolicited racial remarks are absolutely unacceptable. Brokers must continually train and supervise their sales staff to be aware of possible violations.

The Acts Which Constitute Federal Fair Housing:

Civil Rights Law of 1866

“All citizens of the United States shall have the same right in every state and territory as is enjoyed by white citizens thereof to inherit, purchase, lease, sell, hold, and convey real and personal property.”

A discrimination suit may be filed in court by the aggrieved person because of racial discrimination.

The Federal Fair Housing Act of 1968

The Federal Fair Housing Act of 1968, contained in Title VIII of the Civil Rights Act of 1968, made it illegal to discriminate based on a person’s Race, Color, Religion, or National Origin in:The sale or rental of housing or residential lots

Advertising the sale or rental of housing

The financing of housing

There are some exemptions to the Federal Fair Housing Act of 1968. They are as follows:

- An owner of his own property who does not own more than three single-family properties or has not sold more than 1 home in 24 months

- An owner who lives in one apartment in a 1-to-4 family complex

- Religious organizations owned and operated for the benefit of the membership, but not for commercial purposes

- Private clubs that do not open their facilities for commercial use

While there are some exceptions to the Federal Fair Housing Law of 1968, there are no exceptions for racial discrimination.

The 1972 Amendment added “Sex” to the Protected Classes, and therefore made it illegal to discriminate in housing against a person because of their sex.

The Federal Fair Housing Act of 1988

The 1988 Federal Fair Housing Act added handicap and familial status to the existing law.

Familial Status includes:

Families with children under age 18

Pregnant women

Persons in the process of securing legal custody of children under age 18

Handicap

Handicap is defined in the Federal Register Vol. 54, No 13 as the following: “With respect to a person, a physical or mental impairment which substantially limits one or more major life activities; or a person is regarded as having such impairment.”

Handicap is something that limits major life activities, which are:

Self – Care

Manual Tasks

Walking

Breathing

Seeing

Hearing

Speaking

ADA and Federal Fair Housing cover only permanent disabilities rather than temporary disabilities such as a broken leg or arm.

Americans with Disabilities Act (ADA)

This legislation seeks to provide access to commercial facilities and places of public accommodation for all persons with physical or mental disabilities. For purposes of this law, real estate offices are considered to be both commercial facilities and places of public accommodation and, therefore, must comply with all ADA regulations.

Real estate offices are required to have specially designated handicap parking spaces, access to the front entrance (ramps if necessary), and handicap-accessible bathroom facilities.

Affirmative Requirements for Real Estate Brokers

Make reasonable accommodations in rules, policies, practices, or services.

Display the Fair Housing Poster.

Allow for reasonable modifications in staffing.

Train all the staff in the regulations of the Federal Fair Housing Acts.

Do not ask unlawful questions and be consistent with all people.

Listing Agreement should make clear to the seller that discrimination is not allowed.

A real estate professional should make it clear from the beginning that her brokerage company takes fair housing laws seriously. Before even entering into a listing agreement, a real estate professional should explain the importance of fair housing compliance and secure commitment to this before agreeing to list the house. This way, if the seller chooses not to follow the fair housing laws, the agent or broker can refuse the listing.

This discussion and the listing agreement should make it clear that the agent will observe these rules in dealing with the listing and resulting prospective buyers.

The prospective buyer will only be described in terms that do not include race, religion, color, national origin, sex, handicap, or familial status.

The prospective buyers will be identified not by name but by occupation, present residence, or other characteristics of the buyer which could not identify them as members of a protected class.

The facts of the offer should be carefully documented so that the broker cannot be charged with failure to present the offer in a fair and nondiscriminatory manner.

The listing will be terminated if the seller refuses to consider an offer because of race, religion, color, national origin, sex, handicap, or familial status.

Federal Fair Housing Acts have instituted the use of equal opportunity posters (11″ X 14″) for display at brokerage houses, model home sites, mortgage lenders’ offices, and other related locations.

Failure to display the poster constitutes prima facie evidence of discrimination if HUD investigates a broker who does not display the sign. The poster must show the equal housing opportunity slogan: Equal Housing Opportunity

Telephone Solicitation

Telephone solicitation has long been a tool used in the discovery of new listings by sales associates and brokers. Called “Cold Calling,” it is usually the least productive in the arsenal of the sales associate’s tools for finding new business, but it has been done by salespeople for many years.

The telephone solicitation laws of both the Federal Government (the No-call list) and the state of Florida have made the practice of telephone solicitation more difficult. Citizens who are willing to pay $10.00 to be registered with the Florida Public Service Commission can be placed on the Florida no-call list, and they may renew for a cost of $5.00. There is no cost to join the Federal no-call list.

The real estate broker managing a real estate office must be very clear about his position on telephone solicitation and whether he will allow telephone solicitation or not. The broker must be well versed in the Telephone Solicitation law. It says, among other rules, that;

No calls can be made to individuals on the no-cal list unless that individual has called the office and asked for information.

If the salesperson has a prior or existing relationship, calls may be made.

A broker looking for a specific type and kind of real estate property may call, but only to the owners of this type of property, in response to a yard sign or other form of advertisement.

The telephone solicitor must determine that the calls he is making are to people not on the no-call list, either Florida’s or the Federal Government’s. If he so determines that the receiver is not on either list, the solicitor must correctly identify himself with his true first and last name and must state the business he has with the receiver immediately upon making contact.

Any contract made pursuant to a telephonic sales call is not valid unless it has been reduced to writing and signed by the consumer and it must contain all the terms and conditions of the sale with the words immediately preceding the signature: “You are not obligated to pay any money unless you sign this contract and return it to the seller.”

The conditions and rules of telephone solicitation make it very difficult for the broker to control his salespeople. Each violation under the Act is $10,000, plus legal fees. The broker is advised to read Chapter 501.059 Telephone Solicitation and Chapter 5J-6 Telemarketing to be sure of all the ramifications of the law.

Rental lists

There are some real estate brokerages that offer a list of properties available for rent in their community or charge a retainer fee for assisting a tenant in locating suitable rental property. In some cases, these lists are sold for a fee to potential tenants. In order for a broker to legally sell a rental list (or charge a retainer fee for offering assistance to a possible renter), the potential tenant must be provided with a receipt that contains a notice that outlines refund procedures.

There are two situations in which a prospective tenant would be entitled to a refund:

- If any information contained in the rental list is inaccurate, the prospective tenant is entitled to a 100% refund provided the request for refund is made within 30 days of the rental list purchase.

- If the prospective tenant does not lease a property (for any reason) on the list or property shown by the broker who was paid a retainer in advance, the prospective tenant is entitled to a 75% refund provided that a request for refund is made within 30 days.

Violation of Florida rental list laws is a FIRST-DEGREE MISDEMEANOR punishable by a fine up to $1,000 and/or up-to one year in jail. Remember, criminal prosecution can only be by the State Attorney’s office, not the Florida Real Estate Commission. FREC only has the power to issue an administrative fine up to $5,000, take action against a license, or take action against a license application (See Disciplinary Process in Florida)

Note: Any attempt by the broker or consumer to establish terms different from than ones required under Florida law will be ineffective and non-binding.

Summary

The following business entities are authorized to operate as a real estate brokerage in Florida: Sole proprietorship, General Partnership, Limited Partnership, Limited Liability Partnership, Corporation for Profit, Corporation Not For Profit, and Limited Liability Company.

A real estate brokerage desiring to operate under a trade name (fictitious name) can simply register the trade name with the FREC. By registering with the FREC, the brokerage is exempt from all requirements of the Florida Fictitious Name Act.

In the event of a change in the composition of a real estate brokerage General Partnership, the partnership’s registration is unaffected, provided the FREC is notified of the change, and at least two or more partners (one of whom must be an active broker) are continuing operation of the business. If a partner is not properly licensed or registered with the FREC, the brokerage registration is canceled.

Limited Partners may contribute cash or property only. They may not contribute or provide services of any kind to the business.

Business entities that may not operate as a brokerage include Corporation Sole, Joint Venture, Business Trust, Cooperative Associations, and Unincorporated Associations.

Every active broker must have an office which must consist of at least one enclosed room of stationary construction where records are kept and negotiations take place. A branch office is any official office other than the main office of the broker. A temporary shelter that is used for other purposes may not be considered as a branch office (e.g., construction trailer).

The Americans with Disabilities Act provides that commercial facilities and places of public accommodation must provide access to individuals with physical or mental disabilities. Real estate offices are considered to be both commercial facilities and places of public accommodation.

When promoting themselves in any advertisement, if the licensees use their last names in the advertisement, they must also display their last names as registered with the FREC. In addition, licensees are prohibited from using the word “sold” in any advertisement for a property that has not yet closed unless the Seller has given written permission.

Every residential real estate office should display a Fair Housing Act poster. Brokerages that utilize the Fair Housing Act logo have a legal advantage (burden of proof) if the poster is displayed at the brokerage office.

Brokers and their agents should be cautious of cold-calling potential customers by telephone so that Federal or Florida laws are not violated. The Florida Department of Agriculture and Consumer Services publishes a “No Solicitation List” of telephone numbers that may not be called by solicitors unless the potential customer is a former client.

Vocabulary List: blind advertising, corporation, Florida Fictitious Name Act, general partnership, joint adventure, joint venture, limited liability company, limited partnership, ostensible partnership, quasi-partnership, registered limited liability partnership, S corporation, sole proprietorship, telephone solicitation, trade name